Jeroen Dijsselbloem: :

As I said we have not uh, have, we don’t have uh, agreement from the Greek authorities on these papers.

Jeroen Dijsselbloem: :

As they will reflect on their opposition later on. I would first like to ask um, the three institutions, the Commission, the ECB and the IMF, to reflect on the position that we have arrived at, comment or explain the documents. Uh, and in a second round we will [inaudible 00:00:33] going ahead.

Jeroen Dijsselbloem: :

First I think we must welcome some explanation on where we stand and what the documents are, what their status is. [inaudible 00:00:40] start with [inaudible 00:00:40]

Speaker 3 :

Okay, uh, [inaudible 00:00:40] the main element which was uh, on discussion or actually reflect [inaudible 00:01:37] opposition of the program on [crosstalk 00:01:37] on prior action we had uh, very long discussions uh, with uh, different documents [inaudible 00:02:02] number of elements [inaudible 00:02:02] on pensions [inaudible 00:02:02] elements will be explaining more uh, different elements we have the discussion [inaudible 00:02:05] basically as you’ll see [inaudible 00:02:11] proposals there is a joint proposal of the institutions and we must just redirect what we [inaudible 00:02:19] the institutions are working [inaudible 00:02:23] together and [inaudible 00:02:25]. Duration of extension of the program uh, where [inaudible 00:02:42] as institutions we uh, we can’t extend the program for appeal [inaudible 00:02:48] financing. The same thing listing uh, program [inaudible 00:02:52] which means some uh, five months period well a stretch maybe uh six months period [inaudible 00:02:58] on nine months extension [inaudible 00:03:07] institutional financing. So uh, yeah that’s uh a brief o-overview where we are now, so unfortunately uh, we cannot know agreement, documents are there for ministers to see what is the position of uh, the institutions [inaudible 00:03:47].

Speaker 4 :

[inaudible 00:03:48] Greece I think wrote understanding of respected expectations and sure [inaudible 00:03:54] understanding could exist between leaders [inaudible 00:03:59] proposal that can be decided relatively quickly uh, [inaudible 00:04:04] job, they have done it together uh, we have overcome uh, differences of point of views [inaudible 00:04:15] this is a pretty good package. And we deliver today what we consider a pretty good r- uh, plan. With that delivered we enter into discussions on what could after come as implementation. Uh, what are the documents [inaudible 00:04:32] let me explain briefly what’s in there uh, a copy of the memoire, as agreed following this morning’s meeting with the institutions the list of actions [inaudible 00:04:57] uh, a document of financing for consideration uh, overlooking [inaudible 00:05:12] where we are today.

Speaker 4 :

And finally a [inaudible 00:05:17]. What uh institution proposes to be in part of this package [inaudible 00:05:23] offering a long term perspective too. Uh, it matches this fiscal stability and sustainability which is the other necessary side of [inaudible 00:05:35] as I said the last days on our progress have not been in vain. Uh, though I know we are all frustrated we have agreed on a series of proposed elements, fiscal targets, uh, uh, reform of the VAT system causing possibilities for income tax avoidance, reform of the income tax code [inaudible 00:06:00] points that are now in front of you. It is understood that nothing is agreed until everything is agreed. But uh, these elements should not be discounted either. Uh, in these next two hours we must now focus on [inaudible 00:06:34] two parts of which were discussed a lot for hours and hours. [inaudible 00:06:44] VAT and pensions.

Jeroen Dijsselbloem: :

Thank you, let me just uh, add to that, that the uh, debt sustainability analysis document that you have is preliminary. It has been drafted by the two European institutions it’s a requirement which stands at the IMF will need for a final I, uh, debt sustainability analysis are uh, much more extensive, elaborate uh, so the IMF will [inaudible 00:07:10] can go to it’s board, if there is ground to go to its board have a uh, uh uh a different, more extensive DSA, so this is preliminary drafted by the two European institutions for that reason. Uh, just to be precise. That brings me to Mario.

Christine Lagarde :

Thank you very much, uh, Mario’s comment was so short that I’m sure I can be associated with it. And I completely hope at this point Uh, eh, its nice to see a lot of smile on our face after those hours and hours of uh, um very complicated, laborious and uh, fairly unfocused uh, discussions. I just would like to mention that the three institutions have worked together cohesively uh, for quite a few weeks uh, the aide-memoire which I know you have now in front of you, represents maximum flexibility that could be applied to the February memorandum. I insist on the maximum flexibility and the prior action list that you have also in front of you the one that [inaudible 00:08:26] in practical terms the prior actions that would be needed in order to um, respond to the aide-memoire provisions.

Christine Lagarde :

Despite this uh really cohesive work uh, its not been able to uh, reach any kind of agreement really with our Greek collogues. Um, as I said we have have [inaudible 00:08:54] differences. The process has been uh, (silence). I’m trying to put it nicely uh, I think I guess very unpleasant for all of us [inaudible 00:09:08] and so on and so forth. I think I will say no more than that and I just want to also echo and uh, concur with the comments made by Jeroen concerning the DSA that the IMF would use and put on the table of its board, in order for it to disperse, the document that you have in front of you is produced by the two institutions with our input and represents uh, a preliminary assessment uh, with a scenario that we regard as our base finding which is [inaudible 00:09:42] would need to be further developed, as you can imagine, under our principles and submitted to the board. Thank you.

Jeroen Dijsselbloem: :

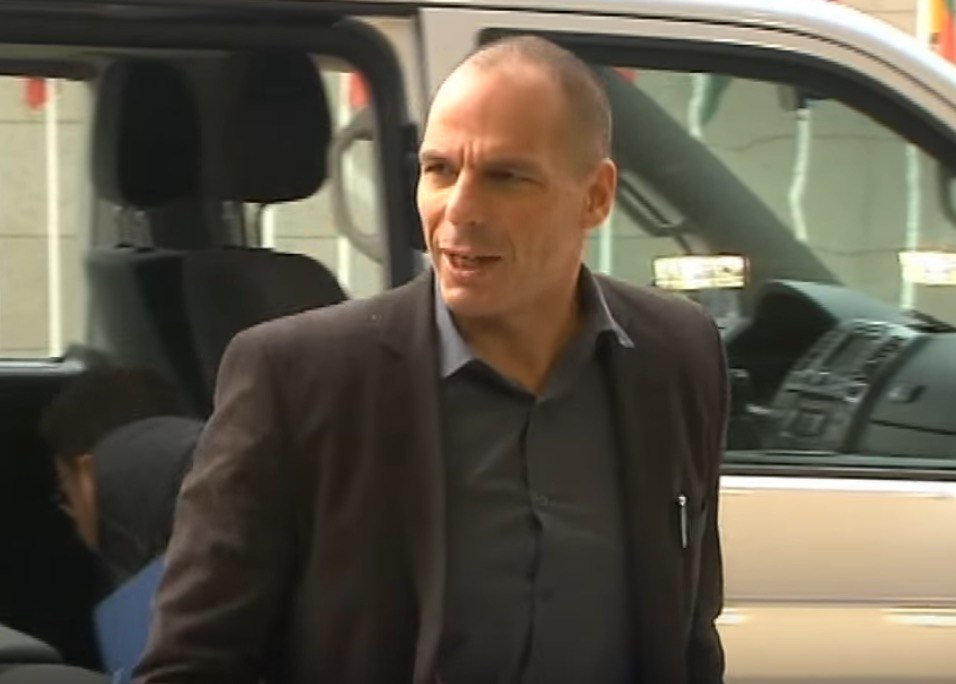

Thank you, no to, to Yanis to hear his perception of where we are.

Yanis Varoufakis :

Thank you Jeroen. As a everyone knows this is uh, this has been a very laborious process. It has been uh, variously um, difficult and sometimes uh, unpleasant. Uh, I have to concur on this but the unpleasantness should not um, deter us from looking at what we have achieved. If you compare the two documents, the document that is in front of you by the Institutions and our document, you’ll find that they are very close. I believe that especially if you take into consideration where we started from and you compare it with where we are, convergence is the only word that comes to mind. We have converged on primary balance uh, targets uh, for the near and medium term. We have uh, exactly the same fiscal baselines scenarios after quite a lot of deliberation on this. For 2015 an 2016.

Yanis Varoufakis :

As a result of this coincidence of primary balances and the fiscal baseline scenario uh, we have um, convergence, complete convergence on uh our estimates of fiscal gaps for 2015 and 2016. There have been a multitude of uh, agreements uh. Most recently it was uh, recommended to use that we should uh, introduce a tax on shipping and ship owners in Greece. Something that previous governments would never have done. Uh, we were grateful to the Institutions for having made that suggestion. It strengthened us and we have adopted it. So this is just one example of last minute convergence.

Yanis Varoufakis :

Uh, our government has um, only two sticking issues picking up the point that uh, Pier made about the two major issues that consumed countless hours of deliberations and negotiations uh. VAT reform on the one hand and pensions on the other. We have proposed uh, a major VAT reform, V-A-T reform. Uh, the estimated yield from that reform comes to 1.7 billion a year, or almost one percent, 0.93% of GDP. We are proposing to um, have a lower rate of six percent just for pharmaceuticals, books and theatrical performances, we have a tradition in Greece of subsidizing the theatre um, a mid-level rate 13%, which is where most the food goes uh, energy, utilities I should say more generally, and uh, hotels which as you can imagine in Greece are a very important part of the economy. And then to um, to, to, to, to 23% which is a top rate, we put everything else.

Yanis Varoufakis :

It took a long time for uh, our technical teams to devise a model that we could use as a common model by which to estimate the impact of different tax rates upon um, our uh, V-A-T take, and this is uh, I consider this to be a successful endeavor on the part of the institutions and us of establishing this common ground uh, in at least in terms of the analysis. Uh, the institutions requested um, that we should get a little bit more than 0.93, t-t- they requested one percent of GDP in extra VAT. We are very close to this. The point I want to make regarding VAT, and I think that this is a point that collogues will take well, it is meant well, is that one of the great problems we have in Greece is um, collectability. Our collectability rates are very low. We’ve had a very uh, bad track record on this and this is where we would want, and this is where we want an AMAT focusing our efforts in order to increase our VAT take. As you all know, when you’re attempting to increase collectability, increase in tax rates and pushing whole categories of goods and services onto the higher tax rate, is not helpful. So there is question here of whether the emphasis of reform should be on changing the tax rate, harmonizing the tax rate or actually on the tax collection system itself.

Yanis Varoufakis :

We believe that it is the latter which will bring in much greater revenues than those estimated but we did not agree with institutions on how to compute, to calculate, to estimate the improvements the different reforms in the tax administration system would have. Um, on the pension system. The institutions demanded uh, a one percent of GDP improvement in the fiscal impact of our pensions system. We have delivered that. We have delivered it in a way which differs from that was, that which was proposed by the institutions, so we are increasing contributions to the pensions’ system together with the drastic elimination of early retirements. The institutions would prefer reductions in the actual pensions rather than increases in contribution. Uh, we are also proposing that is quite significant uh, to our gov- to our gover- to our parliament, we are ready to propose to our parliament uh, that the institutions’ uh, suggestion, that we harmonize contributions between the different funds, in particular between the private sector and the public sector funds, goes ahead at the cost of public sector employees who will have to increase their contributions.

Yanis Varoufakis :

Um, product markets, some product markets, product market reforms, we have agreed upon. Others, we have maintain differences. Let me say collogues at this stage I don’t intend to speak for very long Jeroen, but I do think it is important to mention that this government has shifted a great deal. On almost every front we’ve crossed what we considered originally to be our red lines. What we are asking for, as you can see or hear from what I just said, was a degree of policy space. Christine referred to maximum flexibility, we don’t see that the institutions have applied maximum flexibility. We have applied a lot more flexibility, we’ve bent over backwards effectively in order to come closer or very close to institutions’ position. I believe that uh, in, both in the case of Ireland and the case of Portugal, the institutions showed a great deal more flexibility than um, in what we have experienced over the last few days. And let me just finish by focusing on perhaps the most significant aspect of our disagreement, of the reason why we have not achieved complete convergence yet.

Yanis Varoufakis :

The list of prior actions that we are presenting to you, in the document that you have in front of you, is a very difficult set of reforms for us. It would be very hard for us politically in an economy which is experiencing seven years of unending non-stop contraction of nominal GDP, to introduce measure of two and a half percent of GDP and parametric ones on top of that other non-parametric ones. There is no doubt that especially in view of the dysfunctionality of our banking system as they are over-laden by NPLs. That these prior actions are certainly going to be recessionary. We tried to make them redistributive in a way that is closer to our program. Our program did not envisage such recessionary measures but accepted them. We accepted them to the full magnitude that was request of us. But we have slanted them in a manner which is redistributed, re- redistributive um, in, uh, harmony with uh, our political priorities. We are prepared to take such an SLA, such a set of prior actions through parliament and do it efficiently and quickly. But we are going to face a great deal of discontent, not only from our own government members of parliament but throughout the parliament house.

Yanis Varoufakis :

And the question that we will be asked as ministers in parliament is: you want to ask to pass these prior actions, these are difficult ones for an economy in recession. What are you offering us? Do you envisage that as part of this agreement there is clear sight of an escape from the debt deflationary cycle. That, that we can say that Greece in the next few months can look forward to coming out of the woods, so to speak, of the crisis. The problem, collogues, is that as you, many of you said yesterday in this very room, that this is a set of prior actions that is the foundation for an extension of the program by a few months. Let’s say until the end of the year. Which of course means in the mind of any rational investor that they will think, okay, so another set of negotiations is going to be come to, to, to, to kick in, in November, another set of headlines full of uncertainty and full of concerns about Grexit and about this and that.

Yanis Varoufakis :

I submitted to you colleagues that this kind of extension is simply going to, after a few days of buoyancy in the markets, as a result of having come to an agreement. Very, very soon after that, investors are going to be in suspended animation, they’re going to be waiting to see what happens towards the end of the extension. An economy which is already in a recession and introduces these heavily recessionary measures. Because Let’s face it: two and a half percent, what, however redistributed within the Greek social economy, they are going to be recessionary. Without having a clear view ahead, with these bumpidy payments of the SMP bonds as they are approaching, without any, um, serious discussion of our proposal, which involves absolutely no new money for Greece. Many colleagues mentioned here no new money for Greece. We did not suggest new money for Greece. We suggested an operation involving the ESM, which is perfectly legal which we could agree to it now uh, in such a way as to smoothen out the repayment schedule, the bumpy lumpy SMP repayments over the next year or two, which is the time during which this economy has to achieve escape velocity, so that you and I do not come back here at the end of December with another set of conditionalities, another round of negotiations, another set of meetings perhaps to go again to our parliaments, again to face political pressure both in Greece and in your own polity.

Yanis Varoufakis :

Our hope was that we would be able to agree on prior actions that would be hard for us but which unleash us from the shackles of this never ending cycle of debt deflation. But even at this late, late stage I’m conveying to you our government’s determination to reach the common ground which we set out to reach on the 20th of February, as per the communique. I believe that any impartial spectator or observer looking at the documents will come to the safe conclusion that we don’t have the right as a Eurogroup not to reach an agreement today, thank you.

Jeroen Dijsselbloem: :

Thank you Yanis. Um, there are an number of issues to which I think the uh, the institutions may want to react later on. Perhaps we should give the floor to the ministers first. Wolfgang.

Wolfgang Schäuble: :

So I’m a little bit worried because uh, records we kept now are not in line which uh, this is summarizing, you gave yesterday in our Eurogroup meeting. You summarized yesterday that we uh, would stay in line with the MOU and the statement of the 20th of February. No fresh money, no third program [inaudible 00:24:30] and thereby I have to say [inaudible 00:24:39] flexibility in this proposal of the [inaudible 00:24:56] analysis is a little bit too high, beyond what we can accept. To be very clear, I will give only two examples I have said yesterday. Nobody was listening. Everyone who has to listen, [inaudible 00:25:16]. The complications [inaudible 00:25:23] we were not able, even in an indirect way, to agree on anything that can be understood as a third program [inaudible 00:25:30] we would ask for a mandate from our Parliament. Looking at the financing, uh financing the [inaudible 00:25:52] is only under the pre-condition that there won’t be a new program. If it does it must be…Yanis, listen carefully, because I can read. Therefore, using the HFSF buffer is only possible [inaudible 00:26:34] under the pre-conditions that it will be returned [inaudible 00:26:26]. In this paper [inaudible 00:26:29] is written, I quote, “it is expected that Greece will be able to increase its financing [inaudible 00:26:42] by T-bills. [inaudible 00:26:51] I have to send this paper to my parliament [inaudible 00:27:01]. looking at the debt sustainability analysis [inaudible 00:27:23]. It has been the opposite what has been summarized yesterday. I can, I must say, I must repeat myself, I cannot say [inaudible 00:27:36] SMP profits of 2015 before July. In all financing papers, looking at the situation of the IMF, the assumption is that there will be repayment of [inaudible 00:28:17] will be used to pay the IMF loan on the 3rd of June. There’s no way it would work. I could continue again and again and again and I have about seven major changes of the MOU. If you would follow these two papers, and I would have to ask for any of these major changes to be accepted in the German parliament.

Wolfgang Schäuble: :

Do you really imagine that that would work? Therefore I could strongly argue an answer [inaudible 00:29:04] we are different, not the EU Commission, with all due respect. And we have to ask our parliaments. As it has just been agreed, if the agreement would be changed, we must ask our [inaudible 00:29:24]. And I can’t imagine that I can convince my parliament to accept the part of seven changes in the agreement. You summarized yesterday, MOU segment of 20th of February, using the flexibility in the statement of the 20th of February, we are by far beyond 20th of February. No fresh money, no third program.

Jeroen Dijsselbloem: :

Another colleague who’d like to respond, react question what is on the table.

Speaker 8 :

First of all thank you [inaudible 00:31:07] presenting these papers [inaudible 00:31:07] what is the reason [inaudible 00:31:07] is not the [inaudible 00:31:12] confirmed by all of the three institutions what is the main reason for this so I’m lined with Wolfgang that this problem that there is the last uh, uh, this uh, [inaudible 00:31:31] what is the next step to get through this, together the main problems for the [inaudible 00:31:43] we have now different prior actions [inaudible 00:31:46] we have prior direction planned from the institutions. And I think that the deal is based on this action plan and if we change the figures in the prior action plan I, I, brought on Greece there is probably a totally new [inaudible 00:32:11] uh, which is maybe a totally other view which we have presented now [inaudible 00:32:22] so can anybody say what does it mean that the prior action [inaudible 00:32:28] or is it not possible to change.

Jeroen Dijsselbloem: :

Luis.

Luis de Guindos :

Thank you uh, Jeroen, I’m going to make just a general comment, think that it uh, doesn’t make to much sense to enter into discussion on these measures because I think that we are not done. But I think that we have a real problem. We have a real problem because on the one side we have a political indication that was produced uh, last Monday uh, to do whatever it takes in order to reach an agreement. And to, we have created the expectation that uh, uh, you know is uh, is going to be how is uh, is uh you know the political agreement is going to have the upper hand in the discussions, that will you know I can share this view that this uh, of paramount importance to maintain uh, Greece in the Eurozone, and that we have to reach an agreement before the deadline that we have set that is the end of this month. So that’s the general perception in the marketplace and [inaudible 00:33:47] I don’t know if you have uh, heard uh, different analysis and different research over the last days but uh everybody say you know at the end of the day you know the political agreement is going to prevail.

Luis de Guindos :

But on the other hand, on the other hand, well I’m taking into consideration the different red lines that I am not going to assess in detail, well we have uh, seen that the technical, the technical analysis that’s not adapt that uh take into consideration the red lines of uh, of uh, Yanis. Of the IMF, of uh, you know the, the, the, the DSA the, the financing gaps uh, that you know, we are not going to be able to reach a technical, a technical agreement. I think that this is a very dangerous situation, a very dangerous situation, and I think that uh, well we have to know and we have to decide to go up to what part uh, of the discussion of this dilemma, is going to prevail at the end of the day. Otherwise, otherwise I think that we are going to continue in a sort of stalemate situation. We are going to dent and hurt the credibility of the Eurogroup and we are not going to, to to, to, to, to be able to find a viable solution both for Greece and for us.

Jeroen Dijsselbloem: :

Um, Michel.

Michel Sapin :

(foreign [language) 00:35:24]

Jeroen Dijsselbloem: :

um, Alex

Alexander Stubb: :

Thank you, Jeroen, I have one general, one specific and one question. The general remark is that I have always been a strong supporter of European integration and I think the Euro single market is probably one of the greatest achievements that we have ever done in the European Union. I’ve always been a very strong institutionalist. I think its great that the European Central Bank has exclusive competence on monetary policy and I, I think its great the European Commission has a sole right to initiative and I’ve never been a big fan of inter-governmentalism [inaudible 00:42:12] as such. Now looking at this whole process the way we’ve been trying to take it forward I’m seriously worried about the future of our common currency. [inaudible 00:42:28] some people are saying the we’re losing credibility perhaps, some people are saying we may ping pong back in forth perhaps, but the bottom line is that the longer we let this go on the more people will lose confidence, especially the markets. Uh, in our currency, and I don’t know how to get out of this one, uh, I mean I guess people are talking about two options.

Alexander Stubb: :

One is option A which is some kind of flexibility on conditionality uh, perhaps some kind of discussion of a way out from this dilemma. That will probably weaken the credibility of the Euro. The other one is a plan B. An exit of one of the members of the Eurozone now in the short term immediate term that would probably cause a lot of political and market turbulence. A lot of turbulence in the European project in general, but some say perhaps in the long term it would actually strengthen our common currency. Now I, I really don’t know how we’re gonna get out of, of this one but all I’m trying to say is that the longer we prolong this, to take it to the 11th hour on the 30th of June, the worse of I think all of us are. Now on the specifics, and I say this as a very strong pro-European much like Wolgang. Wolfgang looked at seven differences in changes from the memorandum of understanding. And I have a tendency to agree with those, I’d probably a notch a tiny little notch softer but saying that I simply don’t have a mandate to make a move. Especially on the financing side uh, on the repayments from the EFSF that’s just one example and I think [inaudible 00:44:27] of our parliamentary mandates and democratically legitimacy and how [inaudible 00:44:33] etcetera, etcetera.

Alexander Stubb: :

Uh, sometimes the debate seems to be a little one sided but I agree with all of those including Hans and Luis who said you know we have to sell this at home. Uh, and, and, and what is on the table now [inaudible 00:44:49] institutions might be very difficult to sell it at home and that’s why I come to my questions or point is how, how do we take this forward from here? Because I think it would benefit all of us to, to, to end this as soon as possible. And, and how do you Jeroen..and I, I really don’t envy you in this task, how do you see these next hours panning out because we’re seriously, seriously running out of time and we are seriously making um, I think, yeah. We, we the problem is we’re not increasing credibility of the Euro nor our Eurogroup as such. And by the way I’ll come back to what I said yesterday.

Alexander Stubb: :

Yeah, I’ll ask the Greeks then. Yanis how do you propose to take this forward? Because I made the question, I asked the question yesterday, is there a willingness to take this to the Eurosummit at the 11th hour, basically meaning that the Euro, European Council ends at dinner and there’s another Eurosummit and then once again we convene tomorrow night or Saturday or Sunday uh, and try to find a solution. But uh, I mean we really need to, we need to make a decision now. I think patience is running out at all ends. Sorry for putting it so.

Jeroen Dijsselbloem :

Michael.

Michael Noonan: :

Thanks very much uh, Jeroen. I don’t have a lot to add to uh, what’s been said already. I thank you personally for distributing uh, documents that we are now working on. Documents are always very important. And we’re all on the same documents and on the same page and on the same sentence, which avoids misunderstanding the perspective positions now. I [inaudible 00:46:45] the document generated by the Greek government as well. Which I got just before the meeting. And uh, it’s good to have that on the table. And I uh, would agree with Yanis to say that there’s a lot of convergence between the two positions. That they’re almost at the point of convergence. On the first reading of the documents I thought the two sides were quite far apart on essential issues and if I could trouble you again Jeroen to generate another document and would it be possible for the secretary to uh, amalgamate the two documents on the team by team, topic by topic basis. And uh, on the sentence by sentence show what the institution position is and what the Greek counter proposal is. And then we’ll see very quickly what degree of convergence there is. Of what degree of acceptance of positions there is.

Michael Noonan: :

Second point id like to make is that uh I don’t that the uh, sustainability analysis paper adds up. Uh, there’s a phrase in it about a three year program financed with concessional financing. I have no idea what that means, no idea what that means. And uh, I’d like to see uh documents specify but my first advice um, staff is that the debt sustainability document needs more work. I personally believe it’s flawed and doesn’t for me add up and there are concepts included in it that I’m not quite clear on. [inaudible 00:48:33] I was involved with the Irish program every quarter. Discussions with the Troika. I was in business when the program for Spain, Portugal and Greece were uh, were Greece too and uh Cyprus [inaudible 00:48:47] and there’s one common factor always before agreement is reached and that is the two sides have to trust each other. Now I think there is very limited trust at the table and uh, I think that there’s responsibility on leading negotiations to see that they build on trust because without trust this will not be resolved and uh, we’ll find ourselves on Monday or Tuesday reacting to events rather than controlling events. And I think we should keep controlling of events.

Michael Noonan: :

Final point is uh, I think there’s such a divergence in detail. And that as a Eurogroup we can’t be expected to get involved in the negotiating process. In previous occasions if it’s down to two or three net points that are sticking points, the Eurogroup can come up with the appropriate compromises. But when it’s such a wide agenda [inaudible 00:49:50] it’s not for the Eurogroup to do the detailed technical work. That kind of [inaudible 00:49:57] couldn’t possibly work. So again I reinforce Alex’s point and I uh ask Yanis how does he see the next three days to go? Does he see another round of negotiations between the Greek authorities and the institutions, uh does he see all negotiations parked, uh with some revival of positions uh at the council meeting? And does he see role of the Eurogroup [inaudible 00:50:28] how does he see this playing out? Um, um on the limited timeline that is all available to us? So thank you Jeroen, I appreciate how difficult your position is for as far as I’m concerned you’re doing everything possible to resolve the situation.

Jeroen Dijsselbloem: :

Thank you very much Michael. Um, Jason.

Jeroen Dijsselbloem: :

Thank you. Briefly I would like to join the comments of Luis and Michael [inaudible 00:51:11] and uh, looking at the metrics which is uh, [inaudible 00:51:34] the fact that this matter is unresolved. So [inaudible 00:51:56]

Edward Scicluna: :

[inaudible 00:52:11] Thanking you and institutions for the hard work and also [inaudible 00:52:18] lets start with the obvious, the risk of stalemate today is larger today than yesterday, well because of a, a day has gone by. Because, now we are adding stalemate on the list of measures you know, [inaudible 00:52:39] so uh, are we moving forward or not? I’d like to enlist to share Michel’s view that some progress has been made especially if you look backward and let’s not just uh, throw it out the window, that some progress has been made, yet of course the distance is still very large. Um, but at the same time uh, I, I there is flexibility in what the institutions have achieved so far and what they are putting on the table.

Edward Scicluna: :

So one issue is, to me and either made if I understood it correctly alluded [inaudible 00:53:22] already uh, maybe we need to know more to what extent the different issues suggested by the institutions and on the other side, those coming from Greek authorities, translate into behavior. Many em, eh, mentioned the fact that figures don’t add up. Uh, maybe we should know more, I didn’t have time to uh, study carefully the documents [inaudible 00:53:49] but maybe some further analysis [inaudible 00:53:53] in what sense the figures don’t add up, would be useful. But this is not the point, my only, only point I want to say is the following, this is uh, specially directed to Yanis. Uh, I take it as an obvious fact that we cannot discuss a third program while we’re still discussing the second. Uh, I think Wolfgang is absolutely right on that. At the same time, uh, I do not agree with the fact that it is almost inevitable by Mr. Yanis [inaudible 00:54:26] six months of being here looking at a situation which could possibly worse than, be worse than the one we’re facing now.

Edward Scicluna: :

Uh, how we meet in six months times depends essentially on what it Is done that is achieved in the six months. So my final point is uh, let’s not waste opportunity of uh, of having a time in which measures are implemented and in addition to measures some trust building exercise is carried out [inaudible 00:55:04] again I, I, I [inaudible 00:55:06] Michael point that we need more trust, I couldn’t agree with that and to me trust also, is also built up to implementing as believing that we are all going in the same direction. Thank you.

Jeroen Dijsselbloem: :

[inaudible 00:55:25] Edward.

Edward Scicluna: :

I can’t see uh, myself going back home uh, without an agreement [inaudible 00:55:52] from the Greek side. I’d like also [inaudible 00:56:14] affect credibility [inaudible 00:56:32] once we hear the scenario uh, between now and the end of June [inaudible 00:56:41]

Speaker 16 :

The materials, trying to understand what’s the position of the institutions and the Greek government. I came to a conclusion and I might be wrong [inaudible 00:57:34] but if I understand it correctly, we have this program MOU. And there was an assessment that offered six months approximately, from the change of government. The situation deteriorated so much that DSA or original scenario MOU is so much different than the scenario that we see here. That uh, an adjustment of MOU aide-memoir was the maximum flexibility that was possible to do.

Speaker 17 :

With that being the case I have a problem with understanding how come in six months things changed so much that they cannot overcome this uh, this time difference in reforms that will need a new [inaudible] program with concession of [inaudible 00:58:49] significantly [inaudible 00:58:51] in order to improve the sustainability [inaudible 00:59:10] but that we would have to put funds into it, present value of credits would even further reduced. And we have written off with re profiling already 60% of our credits to Greece.

Speaker 17 :

What I’m asking here is actually is, hasn’t aide-memoir ran too far, isn’t this flexibility been taken too far because of the pressures of the three institutions of our colleagues in negotiations [inaudible 00:59:43]. I, I don’t think that, I would question that memoire and the base scenario that this uh, consequence memoire and [inaudible 01:00:06] prior actions, and if even I’m questioning aide-memoire flexibility going too far, how far do we go [inaudible 01:00:18] this is even further than the aide-memoire. So my question is, Yanis, would you go along with the institutions and say: “it’s okay, aide-memoire is fine in this situation”. And I don’t think that from the point of view of possibility of doing reforms this is acceptable, but let’s say [inaudible] strong negotiations from the Greek side. Then uh, it is unacceptable to deviate from that memoire and go even further. So what my conclusion would be the only thing that we could do today is say to Greeks, take it or leave it that memoire, otherwise we’re really going across any sensible [inaudible 01:01:12].

Jeroen Dijsselbloem: :

Thank you. And I will turn back to the Institutions cause a number of questions have been raised on documents, scenarios, aide-memoire, many questions to the papers uh, that three uh, institutions have put before us, which is the proposal, colleagues, I would just like to stress that point. As a proposal would mean that well be in agreement was just to inform you of the state of play. Having said that, I think those questions need some answers so I will turn to the Commission first.

Speaker 18 :

It’s hard to, to answer all the questions uh, Jeroen. Uh, what I would say is that its difficult to, to compare the two documents because corrections are being made prior version what we ourselves delivered. Uh, I would say that the document [inaudible 01:02:19] is not [inaudible 01:02:22] something composes it uh, which is quite precise and comprehensive and uh well I think all around it is uh balanced it is uh, [inaudible 01:02:47] Greece is uh [inaudible 01:02:55] it is uh, also uh, something which is uh, socially fair. Our idea is that to uh, keep uh, one percent of VAT and [inaudible 01:03:10]

Jeroen Dijsselbloem: :

Uh, Mario [inaudible 01:03:43]

Christine Lagarde: :

I would uh, like to uh, to, to address the last point that as made uh, concerning the situation. What has changed? How can we move from where we were six months ago when there was, written of course ,some primary surplus, and where we are today. I think it boils down to two key targets that have been missed for reasons that we can analyze but the first one is primary surplus which has been much lower than what was expected and I think there has been significant slippages in terms of revenue collections in particular over the last, not just the last six months but over the last 12 months, let’s face it. The whole period of the election was also not good from the revenue collections point of view as is often the case in an election period. Since that, it has worsened and uh the primary surplus that was expected out of the operations of uh, the Greek government and the Greek administrations um, has not delivered what was expected. The general climate of uncertainty caused by, where are we, where is it going, what is the situation, what is the position has certainly not helped in that process.

Christine Lagarde: :

I think the second key shortfall which explains also why there has been so much slippage is the privatization. Uh there was a much higher number that was expected out of privatization I think it’s a constant of the Greek programs for the last five years or so but it certainly has not improved. And what we uh, we are perceiving is certainly uh, a concern by the bidders or by those that would be interested potentially in [inaudible 01:05:48], given the uncertainty in the climate that there is at the moment. So one, one of the major issues is certainly that uncertainty, and that has caused uh, the whole uh, financing [inaudible 01:06:04] situation to actually worsen as a result.

Christine Lagarde: :

The point about the uh, the flexibility which uh, many of you have mentioned is, is correct uh. We have actually collected between the three institutions, we have demonstrated a lot of flexibility not just for the targets on which we have agreement with the uh, the Greek authorities, 1, 2, 3.5% [inaudible 01:06:29] those targets eventually been moved but in terms of the content what will deliver uh , that uh, that, that uh, those consolidation measures and the ultimate result of surplus. We are not, first of all, let’s put it that way we are not in agreement yet. Or maybe we will never be in agreement, I don’t know, I hope it’s a yet rather than never, uh, with the Greek authorities. We, I think, all have a particular concern which we have expressed which is that many of those measures are following suite to the old methods that have been applied by the Greek authorities. Which consist of taxing, taxing and retaxing.

Speaker 19 :

Uh, We certainly would have all preferred that it be less growth and friendly and that there be more in terms of uh, cutting spending than there is on tax revenue generated. Tax as a revenue generating uh, principle. You will see if and when you have time to go though uh, the proposals actually both documents. We think that it’s not particularly growth friendly. Be it as it may it’s even more growth unfriendly in the Greek proposals. Now, why we have not come up with a compare which is you know what uh, lawyers in the room would be used to when you have one document and the other document is because there has been a very um, long standing impossibility for whatever reasons on the part of the Greek party at the table to actually work on the basis of the document. Eventually we came to working on the similar mattress of the document but the last document was put to us at 11:15 earlier today. So as hard as our teams worked and I can assure that they worked the night through. Two nights ago, last night, again, but it was just materially impractically impossible to produce that compare between the two versions.

Speaker 19 :

I’ve gone through it myself a little bit, and there are bits and pieces changes pretty much everywhere in the documents. So that’s uh, that’s where we are.

Jeroen Dijsselbloem: :

Thank you. Yanis, a number of questions were also put to your direction, maybe you could respond.

Yanis Varoufakis :

Yes thank you Jeroen. Let me begin by saying to my Slovenian colleague that uh, and also to others who let it um, sort of created an impression with their intervention that the program was on track until we were elected. Colleagues the reason why we were elected was because the program was off the rails. The only reason. The uh, view that I heard that there was some growth last year is one that I would like very seriously to contest. Nominal GDP never stopped falling. I’ve told you this a number of times. I’m saying this to you again. We never had growth in 2014. Indeed every single target was missed, especially the primary number for 2014. But let’s not look backwards we have a very serious problem here in our hands uh, Christine mentioned that uh, the privatization agenda has not produced the goods, well it didn’t produce the goods in an economy where asset price has collapsed. And therefore it was impossible to reach those completely unfathomable targets.

Yanis Varoufakis :

Uh, the point about the primary surpluses, yes there has been flexibility from the institutions but from what level? From four and a half percent primary surplus projections for the next, for the foreseeable future. I do not know an economist who can testify to having a rationale according to which an economy like the Greek economy under the circumstances could maintain, for the medium term, such a large primary surplus. Three and a half percent is still very large but we have accepted it in the spirit of cooperation.

Yanis Varoufakis :

Regarding our measures that have been um, repeatedly described as not particularly growth friendly, I have to repeat the point I made before that when you have these large measures, uh, they’re not going to be growth friendly. And I made the point yesterday, I have to make it again, that whether you, it, it’s more growth friendly to reduce very low pensions will have a very high fiscal multiplayer or to increase corporate taxes is an empirical matter. I don’t have the numbers here for, yeah I don’t think that anybody does. Uh, it’s only through trial and error that you will work this one out. Um, the point that uh, Pier Carlo made was very important. Because if he’s right, than I’m very happy. If I correctly understand Pier Carlo, you said that you disagreed with me that if we have an extension for six months or so uh, eight months, nine months, whatever, than without a new um, approach to our debt repayment schedule, without any creative public finance, my prognostication was that in a few months time we will be back to where we are now, because the animal spirits will not come back on, because there will be no growth spurt because there will, because all investors, rational investors will be thinking ahead to the next negotiation. Waiting for what happens at the end of it.

Yanis Varoufakis :

Pier Carlo disagreed, he thought that this is not necessarily so. I hope you are right, but I noticed colleagues that at least five of those who spoke, expressed either um, an inability to push through their parliament and through there polity the institutions’ own proposals. Or they said that the, the proposals that are on the table, whether its ours or the institutions’, do not offer a viable solution. Now, this is a very serious political problem, and it speaks to what Michel was saying before. That we have a political duty to come up with an outcome which is sustainable. And I do believe that this is always something that the Eurogroup wants to do and wants to include at the end of every statement, every communique.

Yanis Varoufakis :

That the country, the program country that we are discussing is going to, will have insight market access. This was the point we were raising. The reason why we are um, at, at, uh, um, we haven’t agreed yet is because firstly, we ask for more flexibility, not in terms of the fiscal numbers but in terms of measures within those fiscal numbers, and secondly because we can’t see how this very large package can be pushed through all our parliaments. When there is no prospect for more than a few months of an extension. So I come to the conclusion, to the conclusion, to the question that Alexander amongst others asked, so what do we want to do from now on? What do we foresee as the next few steps.

Yanis Varoufakis :

Let me, let me, let me say that we are very much like you at a loss. We hope that there are steps we can all take. We are constrained like you by our own parliaments, I cannot go to my parliament and table prior actions like you can’t, like you can’t Wolfgang. We cannot push through our parliaments a set of prior actions without being able to answer the question: is this sustainable? My great concern, as a European, not as a Greek at this very moment, is that, and again I’m alluding to something Alexander said about the kind of governance that we have, that this is a major concern for the way we are running Europe. The way we are running our monetary union. We should not be in position where we throw up our hands up in the air, and we declare that we don’t know how to move ahead. We all have the same interests, we all have a common purpose to bring this to fruition, we should find a way of doing it.

Yanis Varoufakis :

I was hoping that today we would be able to come to this agreement. Alexander, I genuinely didn’t want this to go to the Summit tonight or to any other forum. Let us just resolve to make an example out of ourselves so that we can find a way of taking to our parliaments and set of prior actions that will go through the Greek parliament that is sustainable and which you can sell to our own people not just to our members of parliament, honestly and in faith within ourselves that it is truly sustainable. Thank you.

Jeroen Dijsselbloem: :

Thank you. Um, before giving the floor to the rest [inaudible 01:16:14] for returning Mario would like to say something.

Mario Draghi: :

Yeah, j-just one word um, Marcus was sitting and waiting here waiting for the opportunity [inaudible 01:16:24] after we adjourned yesterday meeting [inaudible 01:16:28] and uh, [inaudible 01:16:33] this morning but, institution is fragile. And uh, what seems to me, well, before I come today let me say the set of rules made by the three institutions are sufficient basis for an agreement of an extension. If they were accepted fully by the Greek government. But I mean, that’s why I was reluctant to speak because my sense is that there is no will to find an agreement here. Which case markets will give their response pretty quickly, probably tomorrow. In the course of today, not tomorrows [inaudible 01:17:19]. And then, and the I don’t know, thank you.

Jeroen Dijsselbloem: :

Right colleague, thank you all very much for your reactions and your guidance. Think, listen carefully to what you are saying. On the one hand I think the institutions have put forward proposals that they think uh, are final and credible. Which could be the basis for an agreement. A number of you have questions whether these proposals are [inaudible 01:17:54] tough enough to put it quite bluntly. Uh, uh, that can be debated. On the other hand there are new Greek proposals on some of the prior actions which came in late and therefore I could not hold up sending you the documents. Um, but we recognize some of these proposals that will take us even further from a credible and tough and fiscally sound uh, package. So if you say you must go back and look at these proposals uh, I will ask the institutions if they are prepared to do so. To go through those proposals again. But uh listening to you there is no scope uh, to deviate even more from the MOU, because already you are, some of you are quite critical of the sorry, the aide-memoir and papers by the institution because some of you are already quite critical on whether they are good enough.

Jeroen Dijsselbloem: :

Second point would be that uh, uh, there are also issues of course about debt sustainability, future financing need, the question of a third program. Uh, the way to look at that I think is and has very much to do with trust. To take It step by step, no way can I ask from you or can you ask from parliaments, your parliaments to now agree to future support uh, to Greece. Given the backlash in the program of the last year basically certainly in last half year, the backtracking. So um, I think we should have to take it to rebuild that trust, take it step by step, so we’d be focusing very much on how can we build the package now to come to a successful completion of the current program. Practically speaking that would also mean another extension to get it done to disperse etcetera. The extension can only be limited given the amount of money still available to the current program.

Jeroen Dijsselbloem :

On that basis and if that approach is successful, is successful in the coming months, because the program gets back on track and in the end will lead to a positive uh final review, we could in the fall return to the question, how do we move forward? Uh, and I would not like to exclude that if the program is back on track and Greece [inaudible 01:20:33] would not like to exclude at this point, that we look for further support or ways to help Greece in the future [inaudible 01:20:46] that is the thing, the way I think we could approach this issue. But of course we can only come to that debate if there is an agreement on how to finalize this problem, we’ve always said this, first we need an agreement on what needs to be done and it needs to be implemented successful final review and then we are in a new phase in which hopefully trust has also returned a little and we can talk about the future. Debt sustainability further financial support where needed etcetera, it Is to early now. So that will be my sequencing.

Jeroen Dijsselbloem: :

Anyway returning to where we are now, we need an agreement and many of you are still underlined stressed the importance of an agreement, we need an agreement on how to fix the current program, in a credible way. Um, so what I think we should do is ask the institutions if they are prepared to work with the Greeks on new proposals, but they would have to stay in current lines, and not deviate further. I think this is [inaudible 01:22:12] we cannot go any further than that today, we cannot draw any conclusions either way I would say. So the question to the institutions and the Greek authorities would be if they were prepared to work further. But once again, within the lines uh, of the documents, targets and the goals of the documents that the institutions have presented so for [inaudible 01:22:39].

Speaker 21 :

Of course [inaudible 01:22:42] ready to, to, to engage in that work, that is evident the issues that you just mentioned.

Jeroen Dijsselbloem: :

Mario.

Mario Draghi: :

Christine.

Christine Lagarde: :

I think we’ve always been prepared to work and to put in more time and efforts um. And to answer Michael’s uh, point. Uh, clearly to produce a compare uh would be, would be certainly something we can do. What I just wonder is what is the point? What is the point? Are we going to further gained make progress, that what I’m just curious about? And we have what has been called the aide-memoir which is the sub level agreement, which is as some of you have said the extent of the flexibilities, Some of them, some of you have said it’s to much. So how are we going to make progress is what I want to know? I think the question is really to our Greek collogues. Where do you move, towards what has been put together? And in I found to [inaudible 01:23:54] there has been more backtracking, some changes and movement forward but a lot of backtracking, so where do we go?

Jeroen Dijsselbloem: :

Want to go to Yanis first, I think that’s the logical at the moment.

Yanis Varoufakis :

We’re all in this room hoping for an agreement as I said, but we all have constraints in terms of our mandates. All colleagues do. We do not have a mandate, to um, accept the backtracking that we not is from the institutions. For instance, for days now the institutions have been um, pressurizing us to accept that, this is just an example, that catering In restaurants should go up from 13% to 23% of a um, V-A-T range, and when we, in ,in, in the spirit of cooperation, we said yes last night uh, we were told that this would not yield the improvement in revenues that the, the model we had commonly worked on and we’d agreed would be the common basis, delivered. So we see a lot of backtracking in true from the side of the institutions. Let me give you another example, we are a country that is relaying so heavily on tourism-

Jeroen Dijsselbloem: :

Yanis I’m going to interrupt you- [crosstalk 01:25:20]

Yanis Varoufakis: :

… well let me just, let me complete my, let me, Jeroen let me please allow me to complete my sentence and I will be very brief. Whether I-

Jeroen Dijsselbloem: :

The question-

Yanis Varoufakis :

…we eh, well I’m going to give you an example of a inflexibility that our colleagues should know. We, you all know the extent to which we rely on tourism. There is a demand by the institutions that we take hotels to 23% of V-A-T, when on the opposite coast, a mile, a nautical mile away in Turkey it’s seven percent. Now I do not have the mandate to simply say that for the purposes of a-a-achieving an agreement now I will sign up to this dotted line. This is another example of inflexibility. There is a great deal of this. This is how the Greek side sees it and I think that you should know it. Maybe we are wrong, maybe the institutions are right, or vice-versa. On the question of what, how do we take It from here just like Pier, just like Christine, just like Mario, of course we are willing and ready to continue work but when Jeroen you say that we have to work within the lines I, I need to ask you to tell me exactly what this means. That this means either we accept the document of the institutions or else? Is it what one of the colleagues said that it’s a take it or leave it. Because I just need to convey this to my government.

Jeroen Dijsselbloem: :

I asked the institutions the questions would they be willing and prepared to work further with you? We don’t do the negotiations in Eurogroup. I don’t do the negotiations, they have been trying to reach an agreement with you. Colleagues here have said on the basis of what the institutions have so far together put on the table this is already maybe too much, already deviating from where we set out in the framework of 20th of February. Nonetheless, the Commission, the ECB have said, and, and Christine in principle, have said of course willing to agree, uh, Christine has raised the question, how are we going to get there if you just keep putting in new proposals that’s take away fiscal space that’s uh, take away the urgency from structural reforms, that uh, shift balance even more towards taxes and less to revenue cuts. That is the problem, that’s the circle we’ve been going through now for a long time. So once again uh, what, how much room do you see to reach an agreement? Because, that’s basically the question.

Yanis Varoufakis :

Well I think that the only remedy for this agreement is further conversation, I know no other remedy. On the questions that you raised, I think that they are up for uh, further deliberation. We don’t believe that we are asking for fiscal space, we have agreed on the fiscal numbers. Our proposals about reform simply are different to the institutions. We believe that our reforms are uh, more efficient reforms, we maybe wrong but it’s not a question that we do not want to reform so we are going to do backtracking on reforms. We don’t believe that simply cutting pensions is a reform, it’s a cutback. Maybe we should have it but it, we do not think that this is going to solve the problem of reforming the pension system. But as I said, discussions. Further work.

Jeroen Dijsselbloem: :

Thank you, I’ll give the floor to a couple of colleagues but I think we may need to have uh, a short break uh to decide how to move forward. We’ll go to Wolfgang first.

Wolfgang Schäuble: :

[inaudible 01:29:04] I have to repeat myself. Please have in mind that this proposal of the institutions is not acceptable to Europe. But since we have to accept it, and without fresh money! Without discussing a new program, okay, we can turn it [inaudible] why we gain confidence, trust… At the present I think it would be very [inaudible] that the, the, the prior actions can go wrong, with much more on some measures which will [inaudible] which should be absolutely froze [inaudible] the banks close, if we want even to have a way for the next months a sheer extension with no financing, new financing, then we must rely on more growth. If not, we know that this is not, it will not build confidence, it will do the opposite, it will destroy any confidence in all of us, including the institutions, because this is not a sustainable result, new financing, it’s not [inaudible] we will see if [inaudible] because Greece has to repay the IMF loans – if I got it right from Christine? – and nobody has an answer how to get the money for it.

Speaker 16 :

[inaudible 01:31:10] questions of flexibility, and uh, this the aide-memoir was our agreement from February 20. Uh, you can say no but uh, its uh, as I heard yesterday from Christine it was a question of reaching a compromise. And uh, so we have to discuss [inaudible 01:31:32] the flexibility we thought about at the meeting of February 20. The second thing is it was mentioned by many of the colleagues, it’s the question of trust. If we want to bring this, whatever, to a successful end [inaudible 01:31:51] of the Greek government, as we have seen in the last six months. And the, why we should believe that that is possible? Uh, to bring it to a good end? And mention of the problems was discussed and uh, repeated a new three years program is not possible in this time uh, changing the backbone uh, from [inaudible 01:32:19]..without radio, now we pay the first time in June without any revenue, IMF uh, makes this revenue and probably Spain [inaudible 01:32:53]. If the proposal of the institutions is not accepted we need a new DSA because then we have no analysis if it is that sustainable the changing the program to the Greek, uh, proposal.

Speaker 16 :

Then they start to bring in a new paper, uh, which uh, shows us what is changing in the DSA [inaudible 01:33:41]. And so my question is what are the realistic other alternatives we have to discuss if we cannot find a solution on the proposal we just prepared [inaudible 01:34:19].

Jeroen Dijsselbloem: :

Just to say at one point that [inaudible 01:34:33] the Eurogroup is basically is only interested in agreements with [inaudible] and Greek authorities so that the, the papers are not formal proposal the Eurogroup does not have to take a position its just [inaudible 01:34:56]…to which the Greeks have not agreed, on list of prior actions they have presented a list of changes uh, which we can look at but very general first impression is that it deviates even more. Uh, in fiscal terms and reform uh, terms. Um, on the DSA and I’ll stop again. Um, of course if there is an agreement then there will be final documents and uh, more for us and more final a DSA. So this is just a safe play at the moment, of which Christine has said they will have to do a much more uh, in depth uh, analysis when the time comes. Just to clarify those points. Uh, Luis.

Luis de Guindos: :

Uh, thank you Jeroen, uh I am a little bit confused though uh, perhaps it’s my personal fault. Eh, but uh, well I haven’t said very much to the wholehearted effort that the institutions and the Greek government [inaudible 01:35:53] today for that, uh, the institutions and the Greek government are doing, no? But uh, the main conclusion that I can draw is that we are really far away. I don’t know whether dedicating more time taking into consideration the political uh, uh, economic, financial red lines, we are going to converge, uh. My point goes uh to an event that this is going to take place in two hours time, is our bosses, are gong to gather, you know, we have an European Council going on and to uh, you know my, my boss is going to ask me, uh, what’s the conclusion from the Eurogroup? What’s the situation about that? Well I don’t know what to, to reply because now, now I do not know whether the main reference is going to be [inaudible 01:36:48]…in order to continue the discussions with uh, with uh, uh the Greek government.

Luis de Guindos: :

I don’t know whether you know t-t-t-t-t-the document from the three institutions is going to be you know the basis for uh, the t-t-the future agreement or them or you. Uh, I don’t know what’s our reference now. I don’t know. So, you know, perhaps uh, it would be wiser and a bit more rapid, you know, to say to our t-t-t-to European Council that uh, you know, an agreement this is surly difficult to be reached and to receive some political guidance. Because otherwise I don’t know how we are going to break this sustained [inaudible 01:37:32].

Jeroen Dijsselbloem: :

[inaudible 01:37:38] want to react to parts on the HFSF?

Speaker 16 :

[inaudible 01:37:51] the HFSF will expire the 30th of June if no action is taken. If you, Jeroen, unanimously decide to extend the availability period, this can happen. And I guess you will do that [inaudible 01:38:02]. If the availability period is extended, then you could decide [inaudible 01:38:14] recapitalization, but for other purposes. Again, unanimous decision, would have to be coordinated with the ESM because some money would be needed for Greeks I assume but perhaps not all of it. So these are the different steps but it’s not possible what we discussed yesterday at one point that the [inaudible 01:38:40] or the ESM with a new programme gives money to directly to the ECB to retire the SMP bonds [inaudible: 01:38:52]

Jeroen Dijsselbloem: :

Thank you. Uh, Alex

Alexander Stubb: :

Thank you very much Jeroen. I was listening to what Wolgfang and Luis and then Luis was confused me to but l-let me try to, I mean as a rookie um, I’m trying to simplify grossly the way which I see it. Um, there is a group of Euro countries that have a clear parliamentary mandate which is based on the uh, MOU. Then, there is one euro country which sort of had a mandate for that but not really. Then the institutions where asked to negotiate with Greece a new document uh, which is called aide-memoire, which doesn’t really exist because it hasn’t been proposed. And now we have a discussion on aide-memoir and a possible Greek proposal. Now, there was talk about this being a take it or leave it agreement. And I would have a tendency to agree with that. There’s been strong talk about trust and how to take this forward.

Alexander Stubb: :

And may I, Yanis, put forward a proposal. For Wolfgang, I am taking an extreme. The aide-memoir and the document of the institutions go too far. For you it doesn’t go far enough. The IMF and others have asked you to make sure that you can push it through. My suggestion would be that you take the aide-memoire and a strong set of prior actions to your parliament this weekend. If it passes we will continue to negotiate, if it doesn’t pass that’s the end of the road. Because we have a mandate for the memorandum of understanding but we need to be sure that you’ll be able to push it through a aide- memoire. And right now I sense in Eurogroup that this is simply ain’t gonna happen. So we need to be sure because otherwise it’s going to be impossible for us to take aide-memoir in to the parliaments. So, I would fall into the category of saying, at least from my perspective, we are pretty much in a take it or leave it situation, but you need to tee it up with your parliament first. Sorry for that this is perhaps rookie bluntness, but that’s how I see it.

Jeroen Dijsselbloem: :

Let me make a couple of points on the process also in a response to Luis’s remarks. Starting point for us was you read it in February 20th statements, the old program, the old MOU. But we allowed uh, on two grounds, some flexibility for the institutions to work out a new agreement. Once again for which the old MOU is a basis. The first kind of flexibility was that the institutions, take with a Commission have taken to account the new [inaudible 01:42:13] setback in the economy that could lead to adjustment of the fiscal time as in terms. The second kind of flexibility was new measures could be put into the program because there is a new government but in the end it still has to make sense in a fiscal it needs to bring back the economy on track and it needs to stabilize the financial sector. Those are the three cornerstones. On that basis the institutions have worked jointly uh, and where they are they put just to inform us, in documents of today. These have so far not been acceptable to the Greeks. Now uh, Alex is making a good point, he says that, how can we go to our parliaments if we don’t even know if it’s going to be accepted in Greece. So, in any case, the order in my mind would be that the Greeks go to their parliament first, and get hopefully a very broad endorsement of the package and then, and the time is very limited after the weekend, [inaudible 01:43:24] and then we can continue to negotiate. Uh, I think that will work. Uh, so there needs to be a an agreement uh, and if he wants uh, a take it or leave it approach that is also possible, you can simply say yes. That is also an option, seriously because we are coming to the end of our time, our creativity, our options. Uh, but if you have uh, last proposals that are feasible that will strengthen the credibility I have not seen them but strengthen the credibility, then there is little time left and that’s why in ask the institutions if they will still be prepared to look at that. Um, I’m going to adjourn for lets say ten minutes to talk to the institutions uh, on what options we see eh, to move forward in this process. Just ten minutes.

The audio files are the original and thus more reliable source. The transcriptions accompanying the audio files are there for your convenience; cross checking is recommended before using. We welcome any improvements on what was the best that professional transcribers could produce given the tight deadlines and audio conditions.

Do you believe that citizens deserve to know about these kinds of high-stakes negotiations? Sign our petition to #LetLightIn in our institutions. And if you can, support our work by donating here.